In a world where traditional power structures can seem unyielding, true transformation begins within. Rather than dismantling systems outright, a new perspective suggests that meaningful change emerges when we cultivate a higher consciousness from within these existing frameworks.

This approach—rooted in spiritual awareness and a deep sense of interconnectedness—envisions change as most powerful when it starts internally and radiates outward.

The crises we face today often arise from a disconnection from the sacred aspects of life and the world around us. Reconnecting with a sense of unity and wholeness can help to guide transformation.

When we bring awareness of interconnectedness into established systems, we infuse them with a new light, subtly reshaping them from within rather than confronting them directly. This shift in perspective allows for a gradual evolution, one that honors both the individual and the collective in creating sustainable change.

The concept of “leaders of the new light” embodies this approach. These are individuals who awaken to a higher consciousness and carry this light into their daily interactions, often within structures that seem resistant to change. Their power lies in their ability to remain grounded in compassion and inner wisdom while engaging with systems built on older, often rigid, values. By embodying this new consciousness, they act as gentle catalysts, inviting change through their example rather than force, inspiring transformation without direct opposition.

Rather than tearing down walls, this kind of leader radiates a new way of being that gradually makes the old ways obsolete. When transformation comes from this place of inner alignment, it flows naturally.

Change is sustainable because it respects both the current framework and the higher vision of a compassionate, interconnected future. This approach avoids direct confrontation, which can sometimes lead to defensiveness and entrenchment within old structures.

Instead, it fosters an atmosphere where change feels organic, creating space for a shift that is less about rebellion and more about evolution.

True transformation involves a return to the sacred—a sense of purpose and reverence in how we interact with the world and each other. When we hold this awareness, we create conditions for real change to take root in even the most entrenched systems.

Leaders who embody this approach become living examples, inspiring those around them to recognize that higher vision. They reveal that change doesn’t always come through battle, but rather through embodying a way of being that feels more aligned with compassion, unity, and awareness.

The path of awakening within offers a hopeful roadmap for meaningful, lasting change. By cultivating transformation in ourselves first, we create a ripple effect, carrying this new light into the structures and systems that govern society.

This approach brings the power of true inner transformation into the world, inviting others to join in a shift toward a more harmonious and connected way of life. In times when external change often feels forced or fleeting, awakening within offers a powerful and enduring path forward.

Here are three practical steps to take on the path of awakening within for transformational change:

- Cultivate Inner Awareness Begin by dedicating time each day to self-reflection and mindfulness practices, such as meditation or journaling. These practices foster self-awareness and help you understand your values, intentions, and emotional responses. This increased awareness allows you to bring conscious, positive energy into all your interactions, even within challenging or rigid systems. By grounding yourself in these practices, you align more fully with a sense of inner peace and purpose, which becomes the foundation for inspiring change.

- Embody Compassionate Action Approach every interaction with an attitude of kindness and empathy, especially within environments resistant to change. Small acts of compassion, patience, and active listening can create ripples of positive energy that influence others. Rather than focusing on resistance or opposition, this step emphasizes how you engage—with respect, understanding, and an openness to dialogue. By embodying these qualities, you help transform the atmosphere within existing structures, subtly inspiring others to adopt a similar mindset.

- Integrate Higher Purpose into Daily Decisions Consider how your daily choices and actions align with a larger purpose or vision of interconnectedness. Whether at work, in community settings, or at home, find small, meaningful ways to reflect your commitment to unity and compassion. For example, you might propose more collaborative practices in group projects or seek ways to support others’ well-being. This step encourages you to view every decision as an opportunity to bring a bit of “new light” into existing structures, fostering gradual, positive shifts toward a more harmonious way of working and living.

These steps are about creating change from the inside out, using awareness, compassion, and purpose to gently influence the world around you.

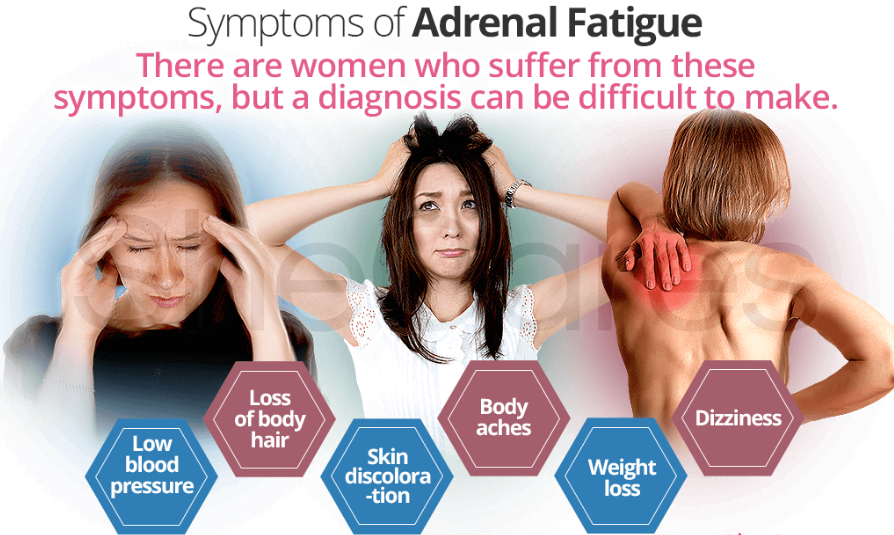

Helping Executive Women Reduce Stress, Prevent Fatigue & Avoid Burnout

📩 Follow me for more insights or send me a message to connect!