In today’s competitive business world, financial stability is crucial for long-term success. Many businesses fail due to financial distress that could have been anticipated and prevented with the right tools. One such tool is the Altman Z-Score, a powerful metric that predicts the likelihood of bankruptcy. Developed by economist Edward Altman in 1968, this formula has become a widely used financial indicator among business owners, investors, and analysts. Understanding the Altman Z-Score can help you take proactive steps to safeguard your company’s future.

1️⃣ What is the Altman Z-Score?

The Altman Z-Score is a formula designed to assess a company’s financial health by analyzing key financial ratios. It measures a company’s ability to withstand financial distress by evaluating profitability, liquidity, leverage, and efficiency.

The standard Altman Z-Score formula for publicly traded manufacturing companies is:

Where:

- X₁ = Working Capital / Total Assets (Liquidity)

- X₂ = Retained Earnings / Total Assets (Profitability over time)

- X₃ = EBIT / Total Assets (Earnings strength)

- X₄ = Market Value of Equity / Total Liabilities (Leverage)

- X₅ = Sales / Total Assets (Asset efficiency)

Different variations of this formula exist for private companies and non-manufacturing firms, making it a versatile tool across industries.

2️⃣ How the Z-Score Works

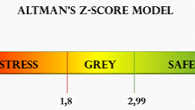

The Altman Z-Score categorizes businesses into three financial zones:

- Safe Zone (Z > 2.99): The company is financially stable and has a low risk of bankruptcy.

- Grey Zone (1.81 < Z < 2.99): The company is in a moderate risk category and requires financial improvements.

- Distress Zone (Z < 1.81): The company is at high risk of bankruptcy and immediate corrective actions are needed.

By calculating and monitoring your Z-Score, you can identify early warning signs of financial trouble and take proactive measures to improve stability.

3️⃣ Why It Matters for Your Business

The Altman Z-Score serves as a financial early warning system, helping business owners and investors make informed decisions. Here’s why it matters:

- Early Bankruptcy Detection: The Z-Score provides an objective measure of financial risk, allowing companies to address problems before they become critical.

- Investor Confidence: A strong Z-Score can enhance investor and creditor confidence, making it easier to secure funding.

- Better Financial Planning: Businesses can use the Z-Score to monitor their financial health and implement necessary changes to maintain stability.

- Competitive Advantage: Companies that manage financial risk effectively have a strategic advantage over competitors who fail to monitor their financial indicators.

4️⃣ How to Calculate & Interpret Your Score

To calculate your company’s Altman Z-Score, you need accurate financial data from your balance sheet and income statement. Follow these steps:

- Gather Data: Extract the relevant financial figures (working capital, retained earnings, EBIT, market value of equity, total liabilities, sales, and total assets).

- Apply the Formula: Plug the values into the Z-Score equation.

- Interpret the Results: Compare your score with the benchmark categories (Safe, Grey, or Distress Zone).

- Take Action: If your company falls into the Grey or Distress Zone, develop strategies to improve financial stability.

5️⃣ Proactive Steps to Improve Your Score

If your business has a low Altman Z-Score, don’t panic. There are several steps you can take to strengthen your financial position:

- Improve Liquidity: Maintain a healthy level of working capital by managing cash flow effectively and reducing unnecessary expenses.

- Enhance Profitability: Focus on increasing revenue streams and reducing operational inefficiencies.

- Optimize Debt Management: Lower excessive liabilities by restructuring debt and negotiating better loan terms.

- Boost Asset Utilization: Ensure that company assets are being used efficiently to generate sales and income.

- Monitor Financial Performance Regularly: Keep track of your Z-Score over time and adjust your business strategies accordingly.

Conclusion

The Altman Z-Score is a powerful tool that can help businesses predict financial distress before it’s too late. By understanding and applying this financial metric, you can protect your company from unexpected bankruptcy, secure investor confidence, and develop a more sustainable business strategy. Whether you’re a startup, a growing business, or an established company, regularly monitoring your Altman Z-Score can provide valuable insights and help ensure long-term success.

Start tracking your Z-Score today—it could be the key to saving your business!