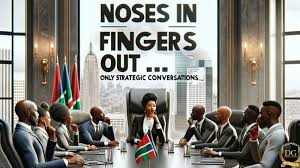

As an aspiring non-executive director, one of the most crucial concepts to understand is the balance between being deeply involved in the governance of a company while trusting the management team to execute the day-to-day operations. The idea of “noses in, fingers out” is the guiding principle that sets effective directors apart. It’s about engaging strategically without micromanaging—especially when it comes to financials.

What Does “Noses In, Fingers Out” Really Mean?

The phrase “noses in, fingers out” might sound simple, but it encapsulates the fundamental role of a director in corporate governance. Directors are responsible for oversight, strategy, and risk management, but they are not there to run the business. The management team, led by the CEO, is responsible for day-to-day operations and execution.

The essence of this principle lies in strategic involvement—directors should be deeply informed and engaged with the company’s financials and broader strategy. However, they should never cross the line into micromanagement of operations. Directors must ask the right questions, challenge assumptions, and guide the company’s direction while allowing the management team to lead.

Why Financial Fluency Is Key for Directors

While this approach may seem intuitive, many non-financial directors struggle with the financial side of things. A lack of financial literacy can lead to uninformed decision-making or, worse, a passive approach where directors fail to challenge critical decisions.

As an aspiring director, having a basic understanding of financial statements and key performance indicators (KPIs) is non-negotiable. But you don’t need to be an accountant to be effective. What you need is the ability to ask the right questions and understand the strategic implications of financial data.

Here are just a few reasons why financial fluency is crucial for directors:

- Informed Decision Making: Directors need to understand the numbers behind business strategies. Whether it’s capital allocation, cost management, or investment decisions, financial knowledge enables directors to steer the company in the right direction without getting bogged down in the details.

- Governance and Risk Management: Financial literacy is also essential for understanding risks—whether they be operational, market-based, or financial. A well-informed director can spot financial red flags, such as declining profitability or cash flow issues, early on and help mitigate them.

- Communication with the CFO and Executive Team: A strong relationship with the CFO relies on mutual understanding. A financially literate director will be able to ask insightful questions during board meetings and have more meaningful discussions with the finance team. This communication helps ensure the company stays on track and avoids costly missteps.

How to Balance the Two: “Noses In, Fingers Out”

Mastering the “noses in, fingers out” approach doesn’t mean directors need to be finance experts, but it does mean they should be strategic and inquisitive. Here are a few key ways to stay “noses in” without “fingers out”:

- Ask the Right Questions: When reviewing financial statements, a director shouldn’t just accept the numbers at face value. Question assumptions—are the projections realistic? What are the potential risks? What’s the cash flow position? A solid understanding of the key metrics will help you ask better questions.

- Focus on Strategy, Not Operations: Directors must always remember their role is strategic, not operational. While it’s important to understand the financial health of the organization, leave the tactical decisions to the executive team. Guide the overall strategy based on your financial insights.

- Use Financial Data to Drive Governance: Good governance isn’t just about compliance; it’s about using financial insights to make better decisions for the long-term success of the organization. Directors should ensure financial data supports the company’s overall strategy and risk management framework.

Conclusion: Financial Fluency for Effective Governance

Becoming a director is about leadership, strategy, and governance. It’s about knowing when to engage deeply and when to step back and let the management team lead. Financial literacy plays a central role in ensuring that directors can be effective stewards of the company’s future, spotting risks, asking the right questions, and making decisions with confidence.

So, aspiring directors—master your financials, stay “noses in”, and trust your team to handle the rest. After all, the best leaders empower others to do what they do best, while steering the ship in the right direction.