The Rise of the Feminine (Edition 3) by Dennis Roberts

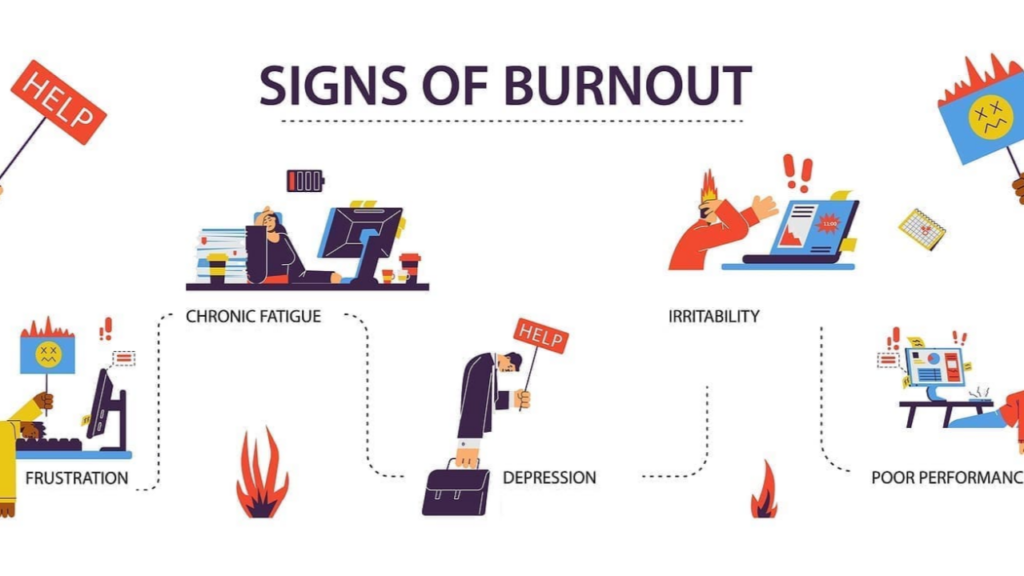

Helping Executive Women Reduce Stress, Prevent Fatigue & Avoid Burnout

Most people think about masculine and feminine energy in terms of personality traits or leadership styles. But what if I told you that these energies are embedded in the very words we use every day?

Language isn’t just a tool for communication—it shapes the way we think, act, and lead. And just like the workplace has traditionally favored masculine energy (structure, logic, hierarchy), so too has our language.

Look at these common prefixes:

- Pro-gress (Pro = forward, assertive, direct)

- Pre-dict (Pre = anticipate, control, preempt)

- Con-struct (Con = build, define, contain)

These are all masculine-coded words, reflecting linearity, control, and singular focus.

Now compare them to their feminine counterparts:

- Re-generate (Re = return, restore, renew)

- In-tuition (In = inward, integrative, perceptive)

- Co-create (Co = together, collaborative, relational)

These words don’t push forward—they move cyclically, weave together, and adapt. This is feminine intelligence in action.

Why This Matters in Business and Leadership

The workplace has long been built on masculine-coded principles: efficiency, results, logic, and competition. But modern leadership is shifting toward feminine intelligence—collaboration, adaptability, and long-term vision.

And here’s the kicker: Our language influences the way we think and lead.

If we’re constantly using masculine-coded words, we reinforce masculine-driven leadership styles. If we reintroduce feminine-coded language, we start to shift how we solve problems, make decisions, and lead teams.

Consider the difference between:

- Progress vs. Regeneration → Are we forcing forward movement, or are we creating sustainable cycles?

- Predict vs. Perceive → Are we controlling outcomes, or are we sensing patterns?

- Construct vs. Integrate → Are we rigidly building, or are we bringing things together organically?

One isn’t better than the other. We need both—but right now, leadership is dangerously out of balance.

The Leadership Shift: Rewriting the Language of Power

The future of leadership isn’t just about changing the way we work—it’s about changing the way we think. And to do that, we have to recode our language.

- Instead of competing, we co-create.

- Instead of controlling, we perceive.

- Instead of driving forward, we return to balance.

This is The Rise of the Feminine—and it starts with how we speak, write, and lead.

What This Means for You

Take a look at the words you use at work. Are they directive, forward-driven, and structured? Or are they collaborative, expansive, and cyclical?

Language isn’t just semantics—it’s how we frame reality. The shift away from burnout, stress, and fatigue isn’t just about workplace policies. It’s about rewriting the entire way we operate.

And it starts here.

Are you ready to shift the language of leadership?

📩 Take The Test and find out where you are in this transition.